The Three-year Business Plan, BEACON 2030 Phase I, covering FY2021 to FY2023, was the first stage in realizing Nihon Kohden’s Long-term Vision. The Company focused on strengthening its business foundation to improve the profitability of its existing businesses and cultivated new business areas and business models. In Japan, the Company promoted creating customer value propositions that contributed to improving medical safety, patient outcomes, and operating efficiency, as healthcare systems to respond to emerging infectious diseases were established and work style reforms for medical staff were implemented. Internationally, while the shortage of nurses and inflation of prices continued to have a negative impact, the Company focused on proposing medical equipment which contributed to easing medical staff workloads and enhancing its business foundation in the U.S. and emerging markets. The Company launched a series of its first new high-valueadded products such as a fully automatic AED, a resuscitation monitor for neonates, syringe pump control software for assisting with total intravenous anesthesia, and a mid-range ventilator developed by Nihon Kohden OrangeMed, LLC in the U.S. Internationally, Nihon Kohden strengthened its business structure. The Company acquired AMP3D, LLC in the U.S. and Software Team Srl in Italy. The Company also reorganized its U.S. subsidiaries into a holding company structure.

As a result, in FY2023 ended March 2024, which was the final year of BEACON 2030 Phase I, domestic sales increased favorably. Overseas sales fell short of the Company’s target on a comparable basis excluding the impact of foreign exchange rates, due to changes in the market environment mainly in the U.S. and China, which the Company has focused on. In addition to actual overseas sales fell short of its target, operating income margin fell short of its target because of increases in the cost of goods sold due to an increase in devaluation of inventories, as well as increased SG&A expenses due to the strengthening of human resources, wage increase, and inflation. Thus, improvement of profitability remains an issue. Additionally, the increased inventories of finished goods and parts to respond to the shortage of semiconductors led to a longer cash conversion cycle, while the Company promoted supply chain management reforms and continued to supply products globally.

Faced with a rapidly changing global situation and a difficult business environment, in BEACON 2030 Phase II, covering FY2024 to FY2026, Nihon Kohden will implement the reform of the profit structure, make investments in growth areas, and establish collaborations between new business models and existing businesses, based on the results and issues of the previous Three-year Business Plan.

- [Growth] Sales CAGR of 5% (FY2023-FY2026)

Enhance product competitiveness, Focus on growth of North America Business - [Profitability] Operating income margin of 15% (FY2026)

Implement the reform of the profit structure of the entire Group, Advance global supply chain management - [Capital efficiency] ROE of 12% (FY2026)

Introduce Nihon Kohden’s own ROIC formula, Reduce cash conversion cycle

- [Growth] Enhance product competitiveness

Nihon Kohden will focus on strengthening its core Patient Monitoring Business and expanding Treatment Equipment Business including ventilators which are expected to grow rapidly as well as Consumables and Services Business and Solution Business including digital health solutions.

The Company will establish a common design platform and multi-plant design, refine cybersecurity measures, and strengthen QA/RA structures. The Company will also shorten the development time for new products by promoting R&D process reforms in addition to the introduction of PLM/MES systems.

* QA: Quality Assurance, RA: Regulatory Affairs, PLM: Product Life-cycle Management, MES: Manufacturing Execution System.

- [Growth] Focus on growth of North America Business

Nihon Kohden will focus on the market strategy in three regions: Japan, North America, Rest of World. In North America, which is expected to high growth, the Company aims to expand its market share and improve its profitability by prioritizing allocation of resources.

[Japan] Strengthen customer base and achieve sustainable growth by enhancing customer value proposition

[North America] Strengthen ties with the major IDN/GPO & DoD/VA and improve brand awareness and profitability

[Rest of World] Comply with laws and regulations related to medical equipment and strengthen local R&D, production, sales, and service capabilities

* IDN: Integrated Delivery Network, GPO: Group Purchase Organization, DoD: Department of Defense, VA: Veterans Affairs.

- [Profitability] Implement the reform of the profit structure of the entire Group

Implement several measures to improve product mix, productivity, and supply chains

- [Profitability] Advance global supply chain management

Enhance PSI (Production, Sales, Inventory) Management, Strengthen global QMS (Quality Management System), Promote multi-plant production

- [Capital Efficiency] Introduce Nihon Koden’s own ROIC formula

Improve operating margins, Strengthen monitoring of return on investment

- [Capital Efficiency] Reduce Cash Conversion Cycle

Strengthen procurement and production management capabilities mainly at the newly established Production Operations, Collect debt faster

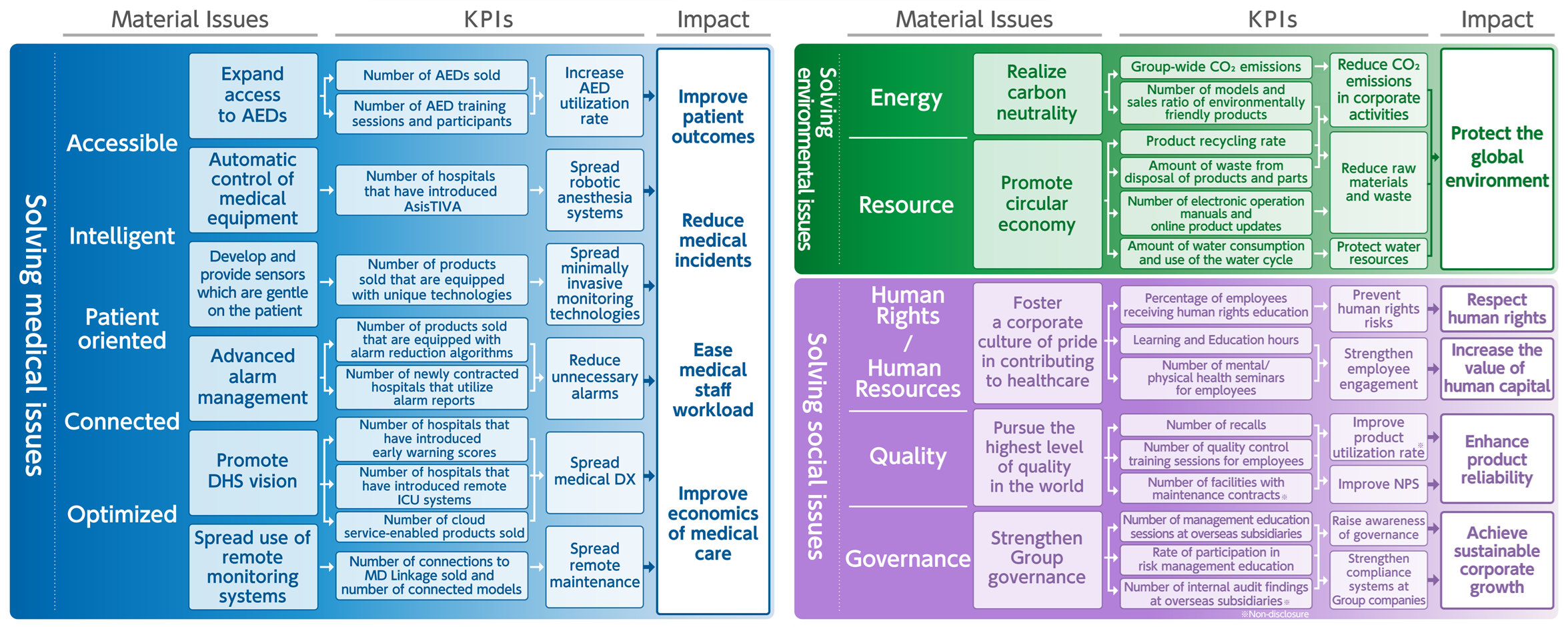

To promote its practice of Sustainability Management, Nihon Kohden will partially review its material issues and KPIs, which were set out in the Phase I. The Company will also work on solving medical, environmental, and social issues through its business and corporate activities.

Based on its Core Values, Nihon Kohden will disseminate the BEACON personnel system introduced in the Phase I and strengthen its operation. The Company will also work on work style reforms and improve personnel productivity. In addition to promoting Diversity and Inclusion, the Company will foster a corporate culture of pride in contributing to healthcare by enhancing career support such as the development of global/DX human resources.

To further strengthen its Group governance, Nihon Kohden will ensure the diversity of the Board of Directors and speed up decision-making by introducing a CxO framework. With the aim of encouraging the sharing of value with shareholders, the Company will also review the remuneration structure for directors.

|

¥billion |

FY2023 actual |

FY2024 forecast |

FY2026 target |

|

Sales |

221.9 |

229.0 |

256.0 |

|

Domestic sales |

142.3 |

147.0 |

157.0 |

|

Overseas sales |

79.6 |

82.0 |

99.0 |

|

Gross profit margin |

50.2% |

51.5% |

53% |

|

Operating incomeOperating income margin |

19.5 |

23.0 |

38.5 |

|

Income attributable to owners of parent |

17.0 |

16.0 |

25.0 |

|

ROIC |

4.0% |

- |

12% |

|

ROE |

9.8% |

- |

12% |

|

¥billion |

FY2023 actual |

FY2024 forecast |

FY2026 target |

|

North America |

37.0 |

38.1 |

50.0 |

|

Latin America |

6.0 |

5.2 |

6.0 |

|

Europe |

13.1 |

12.4 |

14.0 |

|

Asia & Other |

23.4 |

26.3 |

29.0 |

|

¥billion |

FY2023 actual |

FY2024 forecast |

FY2026 target |

|

Physiological Measuring Equipment |

46.5 |

47.9 |

53.0 |

|

Patient Monitors |

84.1 |

87.2 |

98.0 |

|

Treatment Equipment |

51.6 |

53.2 |

63.0 |

|

Other Medical Equipment |

39.6 |

40.7 |

42.0 |

|

In-house sales ratio |

73.5% |

- |

75% |

|

Consumables and services sales ratio |

47.9% |

48.5% |

50% |

|

Solution sales ratio* |

11% |

- |

11% |

Exchange rate assumptions: 140 yen to the U.S. dollars, 150 yen to the euro

* Solution business, software/program, and maintenance services are included.

The total operating cash flow is expected to be ¥80 billion or more over three years. The total amount of R&D costs and capital investments are also planned to be about ¥23.5 billion and ¥25 billion, respectively. The Company will undertake R&D investments in its core business, patient monitors, as well as ventilators and digital health solutions. The Company will make capital investments to construct a new plant in Tsurugashima City, Saitama Prefecture, as well as promoting corporate digital transformation including introduction of PLM/MES systems and generative AI, and advancing supply chain management. The Company will also seek M&A opportunities in the area of synergies with existing businesses, especially for digital health solutions.

Nihon Kohden will make investments for future business expansion and enhance shareholder returns as well as securing a sound financial foundation. The Company has revised the indicators and targets for shareholder returns from a consolidated dividend payout ratio of 30% or more to a consolidated total return ratio of 35% or more. The priority for distribution of profits is i) investment necessary for future business expansion used in R&D investments, capital investments, M&A or alliances, and development of human resources, and ii) shareholder returns. In terms of shareholder returns, the Company will increase dividends in a stable manner in line with growth in business performance. Share buybacks are conducted in a flexible manner, taking into account comprehensively the Company’s future business deployment, investment plans, retained earnings, and stock price level. The Company plans shareholder returns of ¥28 billion or more over three years and will consider additional shareholder returns depending on the progress of its future investment plans.

This document is based on the Company’s evaluations and analyses at the time of writing and does not in any way constitute a guarantee or warranty that the Company will achieve the numerical targets or implement the measures stated herein.